Summary

In today's financial landscape, mastering the art of saving money is crucial for achieving long-term stability and comfort. Our guide presents 11 effective strategies to help you manage your finances better.

Canada is a better country than the USA in several ways, incl. having a lower crime rate. But what’s not better is the two cans of “Pringles” that I just bought; when I tasted them, I was so disappointed. It’s like asking a Canadian to carve a statue of a smiling George Washington, using their own maple tree. Yes, you guessed it, the cans were manufactured in Canada. The cans look enough like Pringles that anyone could be easily fooled. Anyway, I’ll be more careful next time reading labels.

Saving money can be a challenge, but it’s a critical life skill that can put you on the path to financial stability. Money may not buy happiness, but it’s a pretty essential ingredient for living a comfortable life. It’s time to take control of your finances and master the art of saving. Our blog post will show you how to save money in simple, practical, and effective ways. These 11 simple steps will help you develop a simple and realistic strategy to save money so you can live better.

This post contains affiliate links. Please read our disclosure.

1.

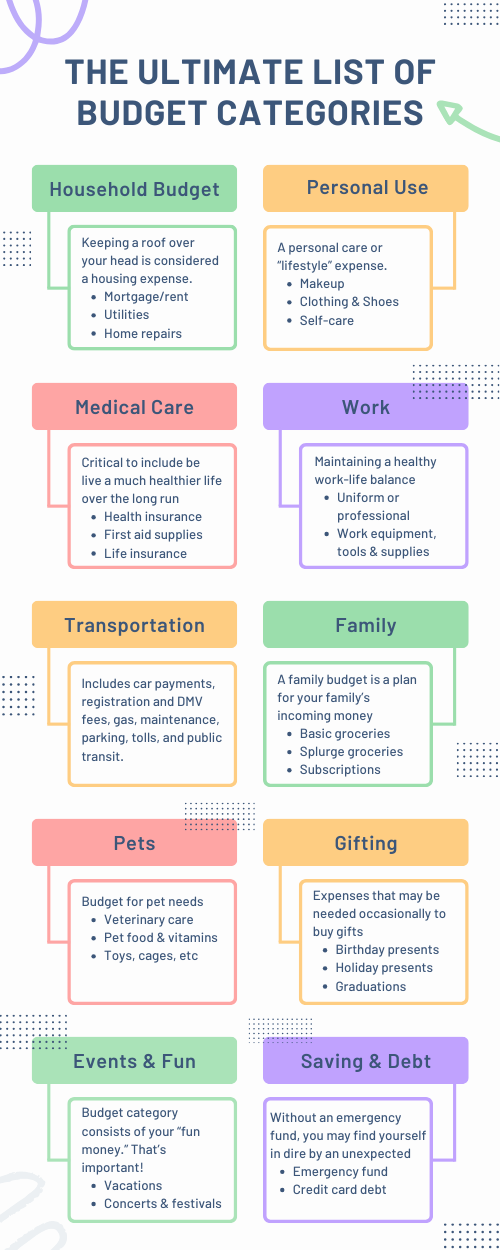

Learn to Budget and Understand Your Finances

The most important tip for saving money fast is pretty simple: Learn to budget. Getting your budget under control is important. But where to start?

Understanding we’re all of your money is going is important if you hope to start saving money.

1. Over the next 30 days, keep track of all the money that you’re spending. This includes utilities, rent, gas, and food.

2. Compare the money that you are earning to what you’re spending to determine whether you are saving money or spending, and if so, how much of either.

3. Separate your expenditures into lists: that which you can change, such as subscriptions, utilities, and food, and another for costs that are fixed, such as rent and certain credit card debts.

4. After you determine which expenses are variable, then go ahead and note the ones that are fixed. The latter you can put aside. As for the variable, you can start asking yourself how you can save money on each.

5. Make sure you assess what you’ve saved and spent from time to time, and make changes when necessary. There are a number of apps that can help you budget if this seems a bit too overwhelming for you at the beginning.

2.

Create a Designated Savings Account

The key to successful budgeting and saving is to keep your earned income separate from your spending money. You can then better track your expenses and make sure that you are putting a portion of your income aside for savings. One way to achieve this goal is by opening a separate savings account specifically dedicated to your savings. This will not only help you keep your money separate, but it will also make it easier to track your progress. Avoiding the temptation to dip into your savings can be a challenge at first, but with discipline and practice, you’ll soon find it easier. To help you stick to your plan, consider setting up automatic transfers from your checking account to your savings account. This will help you save money without even thinking about it.

3.

Find Ways You Can Cut Your Spending

One of the best ways to determine where you can save money is to track your spending. This means keeping a close eye on all of your expenses, no matter how small they may seem. This can be done through a budgeting app, a spreadsheet, or even a pen and paper. Once you have a clear understanding of where your money is going, you can begin to identify areas where you can cut back. For example, you may find that you are spending a lot of money on eating out or buying coffee every day. These small expenses can add up quickly, and you may be able to save a significant amount of money by simply cutting back in these areas.

Here are some ideas to save on expenses:

1. Research local, community events in your area.

2. Consider cheaper places to eat in your neighborhood. You may also wish to consider eating less often at these establishments.

3. Cancel subscriptions you don’t use.

4. Give yourself a period in which you make no impulsive purchases. You’ll be surprised at how easy that this can become over time.

4.

Eliminate Your Debt

One of the most important steps you can take in managing your finances is to take control of your debt. If you’re trying to save money through budgeting but still struggling with a large debt burden, it’s best to focus on paying off your debt first. Calculating the amount you spend each month on debt repayment and interest can give you a clear idea of the impact your debt has on your financial situation. By paying off your debt, you’ll be able to free up more money each month that can easily be put into savings. This will not only help you to achieve your savings goals, but it will also give you peace of mind knowing that you’re no longer weighed down by debt.

5.

Automate Your Savings and Bills

Do you want to save money and make your bank account grow? Automating your savings and bills can help! By automating these tasks, you can set up a regular schedule that will help take care of important expenses while leaving more money in your saving account. This way, when an unexpected expense comes up or the market drops, you’re not as likely to find yourself in a pinch. You should attempt to set aside money each month into their bank account so that they will have enough cash available if an unexpected expense comes up or the market drops. This way, when an unexpected expense comes along or there is a dip in the market, people are less likely struggle because they don’t have as much saved up. Saving money can be difficult, but setting up a regular savings schedule is one way to make it easier.

6.

Cut Back on Rent

Rent is one of the largest chunks of money paid monthly. There are many ways to save money on rent, and some of the most effective techniques depend on what you’re willing to do. First, negotiate fees and discounts with landlords and real estate agents. Sometimes relatively small changes can result in big savings–for example, asking your landlord to reduce the security deposit or fee associated with renewing your lease early. Another option is to look for apartments that are available pre-leased or rented out below market rates. Another way you can cut down on rent cost is to live with a roommate. If you decide to live with three roommates, you would be paying a third of what you’re currently shoving out for housing. (In today’s tough market, there are those who choose to live with even three or more additional roommates.)

7.

Restrict Online Shopping/Use of Credit Card

Impulse purchases can have a major impact on your financial stability, as they can quickly add up and eat away at your hard-earned money. To combat this, it’s important to take steps to make it harder to use your credit card impulsively. One way to do this is by physically hiding your credit card and making it less accessible when you’re out shopping.

For some, this may mean completely cutting ties with their credit card by tearing it up or disposing of it. This can help eliminate the temptation to make impulsive purchases that you may later regret. You may also want to consider setting up alerts or restrictions on your account to limit online purchases or block certain types of transactions. Whether it’s physically hiding your credit card, cutting ties with it completely, or limiting online access, finding a solution that works best for you is key to controlling your spending and maintaining a healthy financial situation.

8.

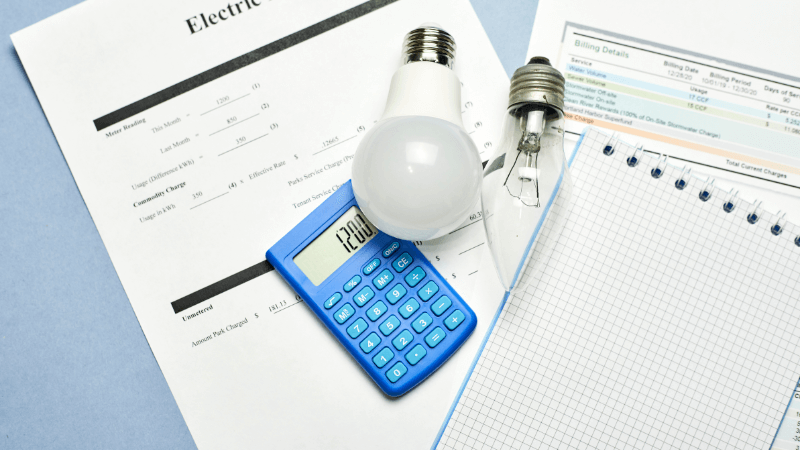

Cut Back on Your Utility Bills

Your electric and gas bill can make up quite a portion of your monthly bill, so reducing costs in these areas would help you go along way. These are ways you can do that:

1. Change your provider. With a simple research, you can locate the cheapest alternative. Many times those were looking to save money are simply deciding to use the same company because they do not realize that there are others that may be less expensive. This simple step alone could save you hundreds of dollars alone per year.

2. Consider investing in a smart thermostat. The device will adjust the central heating, thereby saving you tons of money.

3. Cover up any air leaks in the home. The leaks will cause the central heating to work more. A simple fix such as covering these leaks will do wonders for your pocket. Air resistance strips can be purchased at your local hardware, often for pennies on the dollar.

9.

Control Impulsive Spending

In today’s day and age, it is all too easy for us to succumb to impulse purchases. It all comes down to willpower. Try to commit yourself to not making any large purchases within the next 30 days. Studies have shown that willpower is a bit like a muscle that can be exercised, so it may not be a simple task. That’s okay. Continue to try until you do eventually get it, or rather, it becomes easier. You will thank yourself for having done so.

10.

Pack Lunch and Skip the Coffee

According to recent statistics by statista, the average household spent $8,289 in groceries in 2021. That is an increase of 4.6% from the previous year. Packing your own lunch will save you hundreds a month. This is a habit that can you can begin with a strong enough will, but once you begin it you may even like it enough to continue and never stop.

Try to prepare your food at home. For instance, brewing your own coffee at is much more cost-effective than spending your money every day at a café. When you consider how much you will save each time and how often you go to disestablishment, this will be enough motivation for you to start this financially healthy activity. Plus, you’ll actually enjoy your own coffee and may even decide to quit getting it at a local place entirely.

11.

Try the Traditional Piggy Bank Method

Saving money can often seem like a daunting task, but sometimes the simplest solutions are the best. The traditional method of using a piggy bank to save money is a great example of this. By putting away a little bit of money each time, you can gradually build up your savings over time. Starting with spare change is a great way to get into the habit of saving, and as you become more comfortable with this practice, you can begin to add larger bills to your savings. This can be an effective way to build up a substantial amount of money without even realizing it. Using a piggy bank can also help you avoid impulse purchases as you have to physically save the money before making a purchase. This can provide a sense of discipline and control over your spending habits.

Conclusion

Knowing exactly how much you earn and need to spend can be a good starting point if you are trying to save up. Following a systematic and structured approach can guide you to a realistic strategy of saving money. The 11 tips in this article were meant to achieve that end and will surely be of help in letting you save up and grow your bank account.